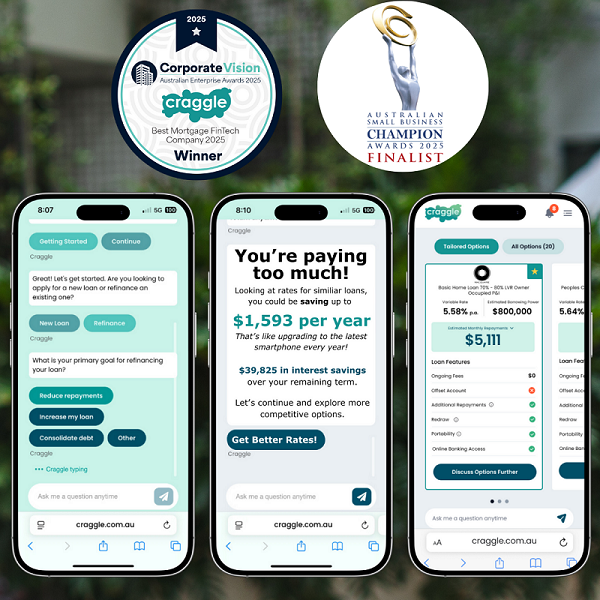

AI-powered mortgage platform Craggle named Best Mortgage FinTech Company 2025

Craggle, an Australian leader in mortgage technology, has been named Best Mortgage FinTech Company 2025 in the prestigious Australian Enterprise Awards, presented by Corporate Vision (and formerly APAC Insider). This accolade recognises Craggle’s outstanding innovation in using generative Artificial Intelligence (AI) to revolutionise the home loan process, making it faster, fairer, and more transparent for Australian borrowers.

A Game-Changer in Home Lending

The home loan journey has traditionally been plagued by inefficiencies, from lengthy research periods to protracted approval processes. Craggle’s AI-driven platform disrupts this norm by allowing borrowers to compare over 7,700 home loan options across 50+ lenders in just minutes, eliminating the need for extensive back-and-forth communication and business-hour constraints.

By leveraging cutting-edge AI, Craggle not only enhances accessibility but also ensures that customers receive unbiased, data-driven loan options tailored to their unique financial circumstances. The platform removes human biases often associated with commission incentives, delivering home loan solutions that truly prioritise the best interests of borrowers.

Industry Recognition & Commitment to Innovation

Corporate Vision’s Australian Enterprise Awards celebrate businesses that demonstrate excellence in innovation, customer service, and industry leadership. In receiving the Best Mortgage FinTech Company 2025 award, Craggle cements its position as a trailblazer in the mortgage sector.

Craggle’s Co-Founder and Managing Director, Benjamin Baume, expressed his gratitude for the recognition, stating, “At Craggle, we are driven by a mission to make home lending simple, transparent, and accessible. This award is a testament to our commitment to empowering Australians with smarter, faster home loan options. We believe that securing a home loan should be a seamless experience, not a stressful one. Through the power of AI, we are not just improving the mortgage process – we are redefining it.”

Craggle’s innovations extend beyond traditional PAYG borrowers, with the company recently launching a first-of-its-kind digital mortgage solution for self-employed Australians. Historically, this segment has been underserved due to complex income verification requirements and limited digital options. Now, self-employed borrowers can enjoy the same streamlined, AI-powered experience as PAYG applicants, ensuring greater accessibility and fairness in home lending.

What’s Next for Craggle?

Looking ahead, Craggle is set to introduce an AI-powered voice-to-voice home loan assistant, providing customers with an interactive, voice-based support system available 24/7. This upcoming feature will enhance accessibility for customers who prefer verbal communication over digital interactions, further solidifying Craggle’s reputation for customer-centric innovation.

“We are incredibly excited about the next phase of our AI evolution,” said Baume. “By integrating voice-to-voice capabilities, we are creating an even more engaging and intuitive experience for our customers. This is just the beginning – our mission is to continuously push the boundaries of what’s possible in mortgage technology.”

Acknowledging Partners

Craggle have stated that their success would not be possible without the unwavering support of its strategic partners, Diego Trigo (Hello Again) and Rami Mukhtar (Emergent Labs). Their collaboration and expertise have been instrumental in developing and refining the technology that underpins Craggle’s innovative platform.

“A special thank you to our partners, Hello Again and Emergent Labs – this award is as much yours as it is ours. Your dedication, expertise, and shared vision have helped us bring something truly transformative to the market, and we look forward to continuing this journey together,” Baume added.