Craggle launches AI home loans for self-employed Australians

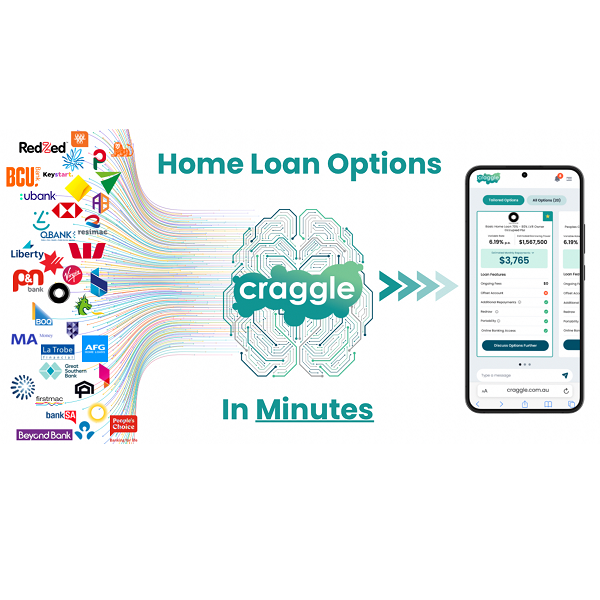

Craggle, the AI-powered mortgage broker committed to fairness and transparency, announce the expansion of its services to better support self-employed Australians. Its innovative platform now helps self-employed borrowers find competitive home loan options tailored to their unique financial situations, making the approval process easier and more efficient.

With lenders prioritising quick approvals for simple PAYG applications, self-employed borrowers – who account for 16% of Australia’s workforce – have often been left behind with digital process typically consisting of a call-back form on a website.

“The home loan market has always favoured straightforward applications, leaving self-employed applicants to deal with complex processes and little digital support,” said Benjamin Baume, Co-Founder and Managing Director of Craggle. “We’re here to change that and provide the same fast, simple, and transparent loan options for all applicants, regardless of their employment status.”

Self-employed borrowers often struggle to identify which lenders align with their unique financial circumstances, with digital home loan processes catering to standard PAYG applicants. Craggle bridges this gap with its powerful AI technology, which scans over 7,700 loan options from more than 50 lenders and, using its proprietary loan matching technology, align borrowers with loans suited to their specific financial profiles. With just a few details, self-employed applicants can quickly discover suitable loan options, with Craggle’s AI providing instant answers to queries, such as loan feature definitions, streamlining what was once a complex, time-consuming experience.

“We’re proud to fill this gap in the market,” Baume added. “Self-employed Australians can now explore tailored home loan options at their own pace, without the pressure of sales calls. Craggle offers the best of both worlds; a fully digital, AI-powered personalised experience, with brokers available for those who prefer a more personal touch.”

Craggle’s AI home loan platform has been in the market for 12 months, with ongoing improvements deployed to ensure the process is simple, fast, and user-friendly. The platform guides users effortlessly, removing the need for complicated instructions and allowing each step to flow naturally. As the first in the market to utilise Generative AI in this way, Craggle faced the challenge of true innovation without any existing frameworks to replicate. With no blueprint to follow, the team has dedicated itself to refining the technology, balancing simplicity with sophistication, and building trust in an AI-driven process. Craggle is committed to setting the foundation for this new type of customer engagement and perfecting it to deliver an outstanding, seamless home loan experience.

Craggle’s commitment to customer satisfaction is reflected in its impressive customer experience rating of 4.2 out of 5, based on ratings provided from over 250 users. Here’s what some of them had to say:

- “It was easy to use, and the agent got back to me quickly with great options.” – Marc

- “I liked that I could ask questions anytime, and the answers made sense. I learned a lot more than I expected.” – Sandy

- “I wasn’t sure what to expect, but it was really straightforward. The whole process was easy.” – Mariana

- “I’ve been meaning to refinance but hate pushy sales calls. With Craggle, I saw how much I could save without talking to anyone first. When I was ready, the agent connected me to a broker, and it didn’t feel salesy at all.” – Justin