Diversiview introduces AI Voice Portfolio Summary for enhanced accessibility

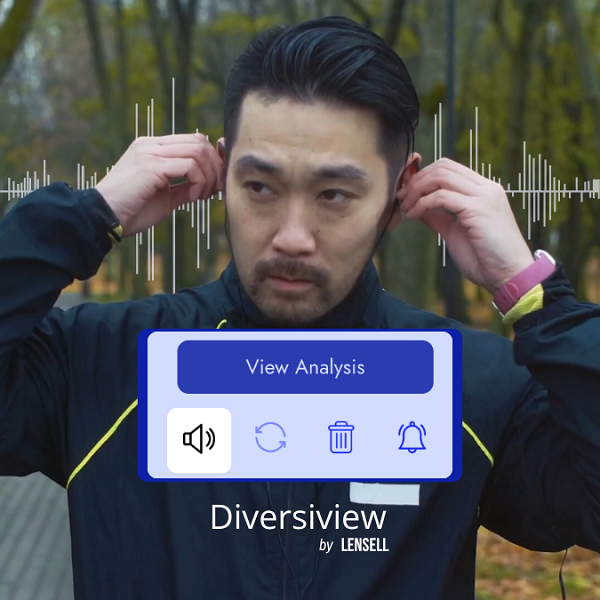

Diversiview, the leading portfolio analysis and optimisation tool developed by the team at LENSELL, have anounced their new AI-driven Voice Portfolio Summary feature.

Diversiview allows investors to analyse the expected performance of their cross-market portfolios and calculate efficient asset allocations that align with their goals and risk tolerance level. This innovative addition is a new way for busy investors to listen to an Artificial Intelligence (AI) generated briefing of their portfolio analyses and optimisations, providing a more accessible and flexible way to stay informed.

Diversiview‘s AI Voice Portfolio Summary intelligently summarises the complex analysis results into easily digestible insights, highlighting key performance metrics and granular diversification information. In less than 5 minutes, investors can gain a comprehensive understanding of their portfolio’s health and potential areas for improvement.

“We believe that technology, especially AI, should empower investors, not overwhelm them,” said Dr. Laura Rusu, Founder and CEO of LENSELL. “By introducing our AI Voice Portfolio Summary, we’re making it easier for our users to stay connected to their investments’ potential, regardless of their location or schedule. This feature enhances accessibility and flexibility, giving investors the freedom to listen to their portfolio analyses on the go, whether they’re commuting, working out, or simply relaxing.”

The integration of the new AI capability into Diversiview’s sophisticated portfolio analysis tools positions them at the forefront of modern financial technology. This cutting-edge feature is just the tip of the iceberg. This is the first iteration of Diversiview’s AI with plans to develop its capabilities further. As Diversiview’s technology continues to evolve, its AI will become more powerful, providing investors with advanced tools to make informed investment decisions in the future.

Sign up for a Diversiview account today for a free analysis of your investment portfolio to gain insights on how you could use technology to increase your expectation of good portfolio returns and mitigate some of the risks you take.