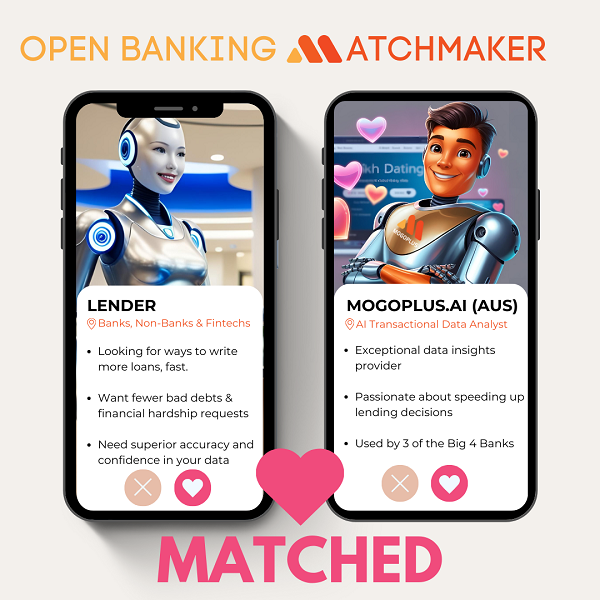

MOGOPLUS’ AI position is strengthened with Google Cloud partnership as lending insight partner-of-choice

Why Every Good Open Banking Participant Needs The Love Of A Data Insights Provider

It is a truth universally acknowledged that every Open Banking participant in possession of a valid accreditation (under the Consumer Data Right) is in search of an ‘Insights-As-A-Service’ provider.

You see, it’s all very well having plugged (or plumbed) in the Open Banking connectors via an Application Programming Interface (API), but then you have to try to make sense of what can often be an amorphous mass of unstructured data, and turn it into intelligent insights that inform better customer decisions.

In the not-too-distant past, Bank Data providers (or screen-scrapers) performed this enrichment (or categorisation) of transactions themselves and, in the absence of anything else, it seemed to pass muster. Up to a point.

Gradually, over time, as the Fintech ecosystem matured and consumers demanded more accurate data insights in money management apps and lenders demanded more accurate insights when writing loans, things started to change.

‘Categorisation-As-A-Service’ providers cropped up internationally whilst some consumers of bank transaction data decided the problem was one they could solve themselves so built their own enrichment or categorisation engines, with varying degrees of success.

Enter: Open Banking

As we move (nay, inch, agonisingly) towards an Open Banking (sorry, it’s the Consumer Data Right (CDR) in Australia) world, a few things are already happening.

Firstly, nearly all lenders who previously used some kind of electronic bank data capture (screen-scraping) will have to:

- Stop using screen-scraping as it is (agonisingly) phased out and banished from our lands forever, and

- Find a new provider of Open Banking data or switch to the Open Banking rails provided by their incumbent provider.

And, unlike in the heady, early days of 2016-2019, the majority of these Open Banking data providers will not offer (or at least not yet) any form of their own data categorisation or enrichment.

So what’s a newly accredited ADR or CDR-Rep (basically an organisation allowed to play within the Open Banking data ecosystem) to do?

Well, it should probably start to look at a data insights provider who can take their raw, largely unstructured data from a range of different sources, and turn it into lending gold-dust.

Enter: MOGOPLUS.AI

Like all good white-knight heroes, MOGOPLUS has a rich and varied backstory, but critically has spent over 10 years working with large, unstructured data sets and turning them into rich lending insights.

The MOGOPLUS suite is used by three of the Big 4 Australian banks, who trust the accuracy of the insights provided by the categorisation and subsequent enrichment of transaction data from a range of sources.

A focus on further improving accuracy and match rates through agentic Artificial Intelligence (AI) is evidenced by a newly bolstered data science team led by Muhammad Hejvani and Anthony So, and a burgeoning partnership with Google Cloud, whose marketplace will now feature MOGOPLUS’ AI solutions and allow organisations to test MOGOPLUS products via a self-service portal.

The Fruits Of Lending Love

So where does this fairytale romance end? Once you’ve married your fully compliant Open Banking data to Lending Insights, what can you expect from this happy union?

Here are the benefits of a harmonious marriage between Open Banking data and a reliable suite of Credit Decisioning insights:

- More Loans In Less Time – Assess credit and process loans in 1 hour… not 6. Speedier decisions means more loans, written by fewer people.

- Better Business Processes – A.I-based credit decisioning removes friction throughout the lending journey, delivering better business outcomes.

- Less Bad Debt & Financial Hardship Requests – Achieve more accurate decisioning whilst maintaining acceptance rates and reduce resources required for hardship requests

- Happier customers – Faster lending decisions (hours not days) makes for happier customers more likely to refer you to friends and family.

- Future Prediction Power – Predict future hardship and avoid losses through ongoing credit monitoring and proactive account management.

Interested to learn more? Visit mogoplus.ai or reach out at [email protected]