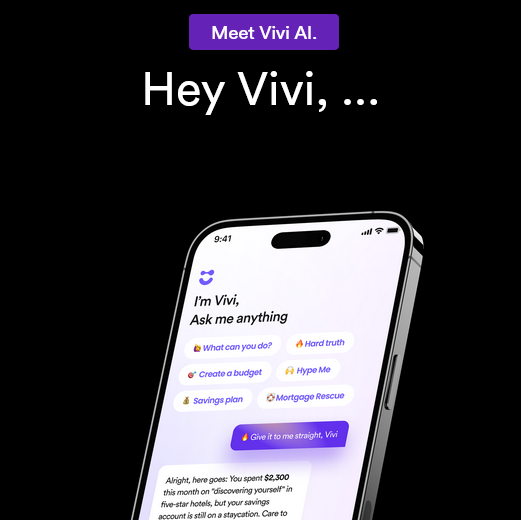

Vivi Money launches Australia’s first conversational AI Money Manager

Vivi Money have announced the launch of the country’s first conversational AI Money Manager at the heart of its all-in-one financial platform encompassing a transaction account, smart financial tools and high interest savings.

The vision of 22-year-old Byron Bay entrepreneur Will Cormack, Vivi is looking to simplify how Australians engage with their finances — through smart, accessible, and inclusive AI-driven tools.

Vivi leverages Open Banking protocols to securely link a user’s bank accounts, credit cards, loans, and super funds, offering a centralised financial view powered by intuitive conversational AI. It doesn’t just show balances and transactions; it provides tools and insights enabling real-world questions like:

- “Give me the hard truth on my spending habits”

- “Help me budget for a trip to Bali”

- “How am I tracking to my mortgage deposit goal and what can I do to get there sooner based on my revised salary”

One of Vivi’s signature features is Mortgage Rescue — an AI prompt that analyses a user’s current home loan and compares it to their lenders current rates to ensure they are getting the beast deal from their bank and providing negotiating insights. The AI Money Manager can even compare their current lender to market alternatives and advise significant potential savings.

Vivi Money has new products to compliment the AI Money Manager which will launch in coming months:

- Vivi Debit Card with market leading FX for travel savvy consumers

- High-Interest Savings Account at call linked to major Australian fixed income funds

- RetroPay – a first-of-its-kind feature that lets users retroactively convert any purchase made in the past two weeks through any connected bank account into an instalment plan

- Goal based savings pots for setting targets and tracking progress with AI notifications

- In app cheap fuel alerts and travel agency

Vivi’s world-class, end-to-end technology stack has been engineered with industry-leading security protocols and compliance. The AI financial assistant is culturally adaptable, with the ability to serve diverse demographics, languages, and user preferences. This allows international partners to easily integrate Vivi’s capabilities into their platforms through proven integration rails.